A payment gateway is a software that lets online stores accept customer funds. It is a middleman between the customer’s browser and the merchant’s server. It encrypts sensitive card information and sends it safely to the merchant’s server. Here are some of the most essential parts of a payment method for online businesses payment gateway In India

Standards for encryption: A payment gateway should use high-level encryption standards to keep customer information safe from fraud and illegal access. SSL (Secure Sockets Layer) is the most popular encryption standard. It makes a secure connection between the customer and the payment gateway.

Multiple processors: A payment gateway should let merchants connect with various payment processors, like banks or card networks, to offer more payment choices and lower the risk of downtime or rejection.

Scalability: A payment gateway should handle many operations quickly and satisfactorily. We should also be capable of adapting to the changing wants and preferences of customers and the market. 1. Support different payment options: A payment gateway should support different payment methods, such as credit cards, debit cards, internet banking, e-wallets, cash payments, or PayPal. It should also work with different currencies and languages so that it can serve customers all over the world.

A payment gateway in India should handle invoicing, bills, reporting, and reconciliation. It should also have tools like recurring payments, subscription management, refunds, chargebacks, and protection against fraud. Processes should be automated.

Easy online integration: A payment method should be easy to connect to a merchant’s website, shopping cart, or e-commerce platform. It should also have APIs (application programming interfaces) and SDKs (software development kits) for custom interaction with other apps or systems.

Fees and service agreements: A payment gateway should have pricing plans that are clear, affordable, and fit the budget and business model of the merchant. It should also have transparent and fair service arrangements that spell out the terms and conditions of the service, such as security, responsibility, support, and how to settle disagreements.

Mobile payments: A payment gateway should let merchants take payments from mobile devices like smartphones and tablets. It should also have features that work well on mobile devices, like a flexible design, QR codes, near-field communication (NFC), or biometric authentication.

These are some things a payment gateway should have to make it easy and safe for businesses and customers to pay online. Merchants can boost their sales, customer satisfaction, and loyalty by choosing a reliable and well-known payment gateway provider.

Several different payment gateway solutions are accessible to companies in India. Some of India’s most widely used payment gateways are as follows:

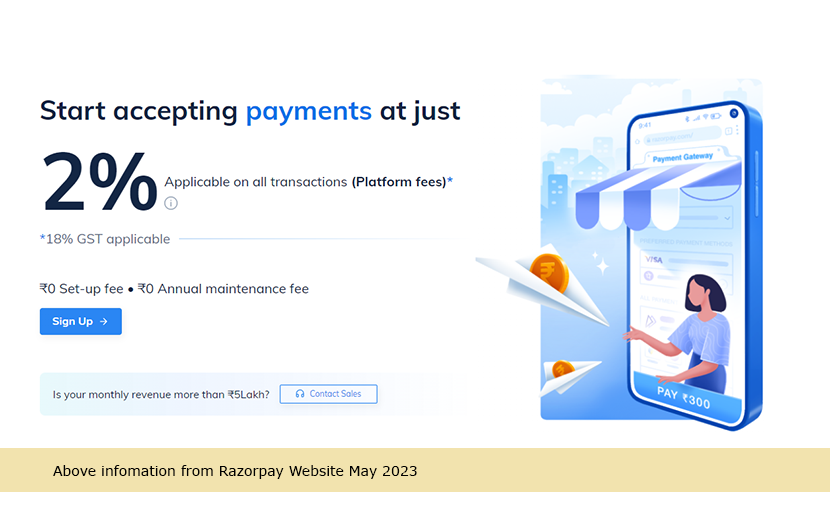

Razorpay

One of the most widely used Indian payment gateways is called Razorpay. Several different payment options may be used with this system.

Razorpay is an all-encompassing solution for businesses of all sizes due to its support for various payment methods. In India, Razorpay is one of the most widely used payment gateway services, allowing merchants to accept multiple types of payments. Its headquarters are in Bangalore, India, and began operations in 2014.

The simplicity of using Razorpay is one of its most appealing qualities. The platform’s friendliness to users and ease of integration make it ideal for businesses eager to begin receiving payments immediately. Razorpay delivers a dashboard with real-time insights and analytics, among other tools and services, that can aid businesses in managing costs more effectively.

Razorpay is preferable because of its emphasis on safety. The platform is PCI DSS compliant and includes modern security methods like 256-bit SSL encryption and two-factor authentication to safeguard consumer information at all times.

With no monthly or annual fees and a transaction cost that varies with the selected payment method, Razorpay is priced competitively. In conclusion, Razorpay is a well-known and trusted payment gateway service in India, providing numerous options for streamlining business payment processing.

Paytm

Paytm is a well-known online payment system in India that provides payment gateway services for companies. It debuted in 2010 and has its headquarters in the Indian city of Noida. Businesses of all sizes can benefit from Paytm’s all-in-one solution because it accepts various payment types through cards, online banking, UPI, and wallets.

Paytm’s user-friendly interface is a central selling point since it facilitates rapid integration and payment processing for businesses. In addition to real-time transaction tracking, extensive data, and adaptable payment sites, Paytm provides tools and services that may streamline the payment management process for businesses.

Paytm’s dedication to safety is yet another perk. The platform is PCI DSS-compliant and includes modern security methods like SSL encryption and two-factor authentication to safeguard consumer information at all times. Paytm’s price is very reasonable; there are no monthly or annual fees, and the transaction fee varies with the type of payment method chosen. Regarding payment gateways in India, Paytm is widely recognized as a dependable service that provides numerous valuable features and solutions for businesses. Businesses of all sizes can benefit from its affordable price tag, high level of protection, and straightforward UI. Instamojo is a well-liked payment gateway that caters to micro- and medium-sized enterprises. Credit cards, debit cards, internet banking, the Unified Payments Interface (UPI), and digital wallets can all be used.

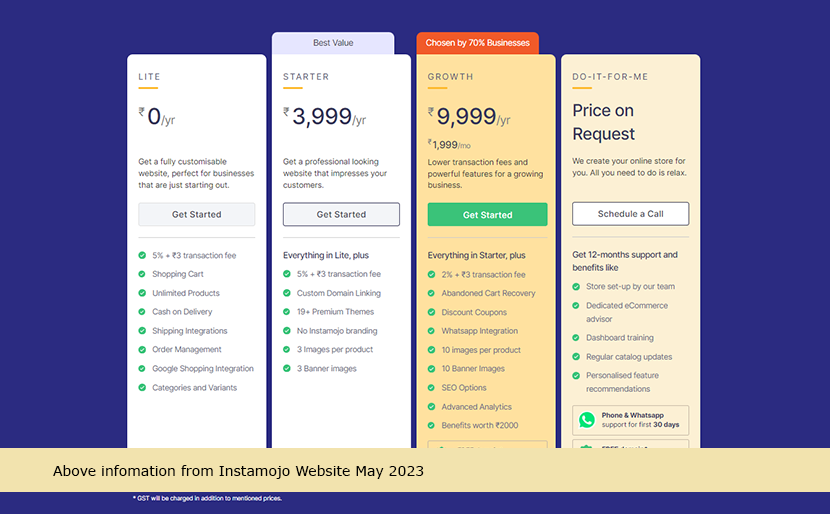

Instamojo

Instamojo is a widely used payment gateway that mainly caters to Indian SMEs. Its headquarters are in Bangalore, India, and it began operations in 2012. Instamojo is a complete solution for businesses because it accepts various payment types (credit cards, debit cards, net banking, UPI, and wallets).

The simplicity of Instagram is one of its most appealing qualities. The platform’s friendliness to users and ease of integration make it ideal for businesses eager to begin receiving payments immediately. Instamojo provides several features, such as payment page customization, automated payment reminders, and real-time data, that can aid businesses in more effectively managing their payment processes.

Instamojo’s focus on helping small businesses thrive an additional perk. Small businesses can take advantage of the platform’s plethora of supplementary services, which include e-commerce, inventory management, and shipping options.

In addition to its low prices, Instamojo requires neither monthly nor annual subscription fees and levies a transaction fee that varies with the chosen payment processor.

Instamojo is a trusted and widely used payment gateway service in India, providing numerous options for improving how small and medium-sized enterprises handle financial transactions. Enterprises searching for a complete payment gateway solution will find it a suitable option because of its user-friendly interface, support for small enterprises, and affordable price.

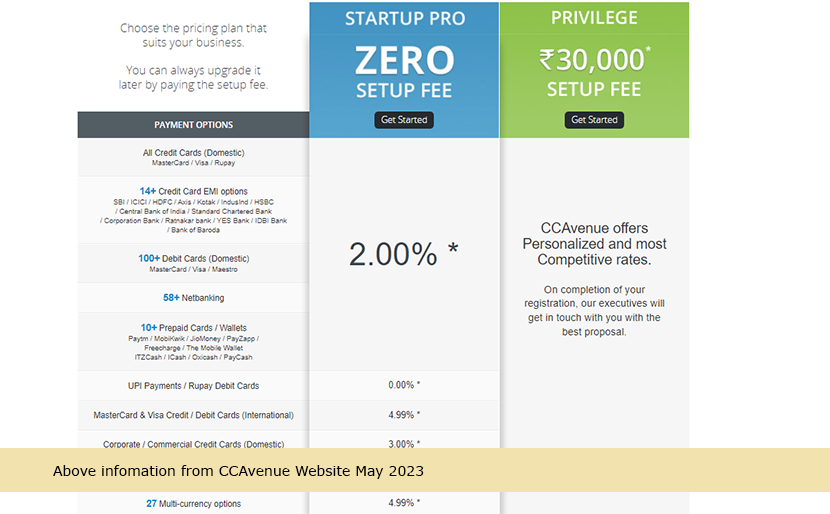

CCAvenue

CCAvenue is a payment gateway that has existed in India for quite some time. Several different payment options may be used with this system. Founded in 2001, CCAvenue is India’s longest-standing payment gateway service provider. It’s a comprehensive option for businesses of any size because it works with various payment types (credit cards, debit cards, net banking, UPI, and wallets).

The international scope of CCAvenue is one of its most notable qualities. The platform’s flexibility in accepting a wide variety of currencies and payment types makes it useful for companies doing business on a global scale. In addition to real-time transaction tracking, customizable payment pages, and in-depth reporting, CCAvenue provides a wide variety of tools and services that can aid businesses in better managing their payment processes.

CCAvenue’s security features are among its many benefits. The platform is PCI DSS-compliant and includes modern security methods like SSL encryption and two-factor authentication to safeguard consumer information at all times.

With no monthly or annual fees and a transaction fee that varies with the type of payment processed, CCAvenue is priced competitively.

CCAvenue is a widely used and trusted payment gateway service in India, providing numerous options for streamlining financial operations. It’s an excellent option for companies seeking a complete payment gateway solution due to its global reach, high-security standards, and reasonable prices.

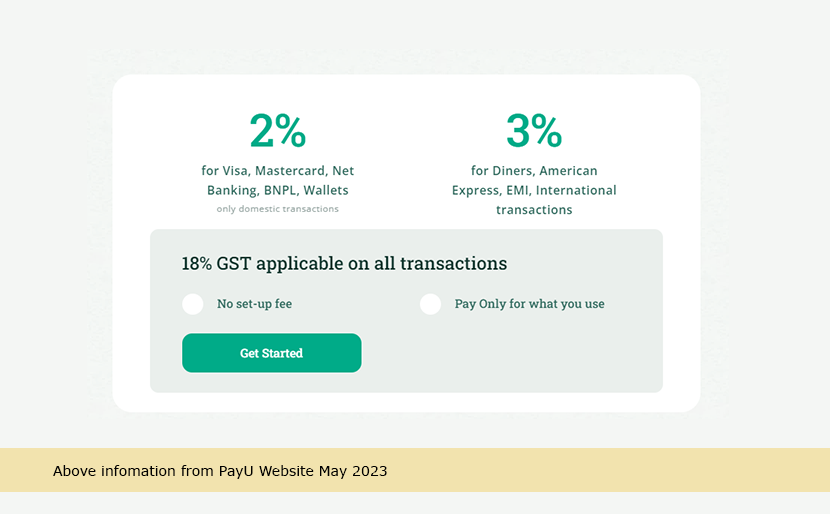

PayU

PayU is a payment gateway service that works with companies of all sizes. Credit cards, debit cards, internet banking, the Unified Payments Interface (UPI), and digital wallets can all be used.

PayU, one of India’s most widely used payment gateway services, allows customers to make purchases via various methods. The company has been around since 2002 and is based in Noida, India. PayU is a complete solution for businesses of all sizes because it accepts various payment types (credit and debit cards, net banking, UPI, and wallets).

PayU’s adaptability is one of its most appealing qualities. In addition to real-time transaction tracking, detailed reporting, and fraud detection and prevention capabilities, PayU offers a variety of tools and services that can help organizations manage payments more efficiently. The platform’s flexible integration choices let businesses pick the best technique, from APIs and plugins to hosted checkout pages.

PayU has a lot going for it, and one of those things is its commitment to safety. The platform is PCI DSS-compliant and includes modern security methods like SSL encryption and two-factor authentication to safeguard consumer information at all times. PayU also has reasonable prices, with no costs for set up or upkeep and a transaction fee that varies with the chosen payment gateway. PayU is a trusted and widely used payment gateway for businesses in India that provides several useful features and tools for handling financial transactions. Businesses of every size can benefit from its adaptability, security-first philosophy, and affordable price.

These are some of the many Indian companies that offer payment gateway services. Considerations such as transaction fees, security, convenience of use, and customer service should be made before deciding on a payment gateway provider for a business.

Cashfree

Cashfree is a payment gateway that offers 120+ payment options, including Pay Later, Cardless EMI, Paytm, and more. Cashfree Payment Gateway has an instant refund policy within 5-7 working days.

Cashfree Payment Gateway

1. To improve the effectiveness of the writing, it could be beneficial to provide more information on the specific fees associated with using Cashfree Payment Gateway. This can include the percentage of transaction fees and any additional charges that may apply to specific payment options.

This will help potential users make an informed decision on whether Cashfree Payment Gateway is the right choice for their business.

2. Another way to improve the effectiveness of the writing is to provide more details on the security measures taken by Cashfree Payment Gateway to ensure the safety of transactions. This can include information on encryption standards, fraud detection methods, and compliance with industry regulations. This will help build trust with potential users and increase their confidence in using Cashfree Payment Gateway.

3. Lastly, clarifying any restrictions on the types of businesses that can use Cashfree Payment Gateway may be helpful.Examples of industries or business types that are not supported can be provided, or specific criteria must be met to use the gateway can be outlined. This will help potential users understand if their business can use Cashfree Payment Gateway and avoid confusion or disappointment. This ensures that Cashfree Payments Merchants can delight customers while running their business smoothly.

Cashfree Payments is an online payment gateway that offers many web integrations. You can pick an easy-to-integrate Cashfree Payments gateway or custom-made checkout integrations, such as Seamless Basic and Seamless Pro, can be implemented.

Cashfree Payment Gateway permits businesses to obtain domestic and international payments with various options. With our pre-built integrations, you can collect payments directly from your customers. You can also customize the payment flow for your customers (Seamless Basic or Seamless Pro) according to your business requirements.

E-Commerce Website

Here are some essential elements to think before setting a payment gateway for an e-commerce website:

User experience: With payment gateway integration, it has to be offered as quick payment processing and customization options

Payment Options: A payment gateway should provide a variety of payment methods

Secure: Any firm that accepts payments online must have a secure transaction as a top priority

Location: The place of your industry should be considered as different gateways can be famous and more achievable in other countries

Currency Support: This aspect also depends on the country of operation and the spectrum of your business. The payment gateway should support the currency you deal with.

Web Development

Web developers are crucial in integrating payment gateways into websites or apps. They are responsible for the technical implementation of the payment gateway. This includes setting up the payment gateway API, configuring the payment gateway settings, and testing it to ensure it works correctly.

For developing a complete ecommerce website please free to contact +91 9656180219

payment gateway In India, ecommerce website, ecommerce website Development, ecommerce mobile app development

Leave a Reply